It’s becoming harder to ignore and shun away the whole crypto thing. With Bitcoin’s market capitalization reaching a monumental $1.1 trillion in 2021, many skeptics seemed to be running out of arguments against the controversial set of currencies.

Table of contents:

How to Diversify Crypto and Reduce Risk

As 2022 nears an end, crypto has gone through many controversies and turbulence, such as the FTX collapse or the $570 Million Binance (BNB) Hack. Yet, here we are, and the cryptocurrency market seems to be doing just fine.

It is also difficult to ignore that the crypto market is still comparatively new and faces many missteps. As a trader, you must know how to trade your assets safely and reasonably.

In this article, I’ll discuss why crypto diversification is essential and how to keep an eye out for it when choosing your next coin. To learn about the assets that are best to trade by beginners, read our guide “Crypto, Stocks, or Forex. What’s Better To Invest In?”.

1. What is the point of asset Diversification?

The role of diversification is pretty straightforward. In a nutshell, you’re looking to minimize the risk of losing your holdings all at once. So, you’d generally rather have 10 apples than one, as it is far less likely (although not impossible) for all ten at once to rot.

To achieve that, you will have to invest in several separate assets. To some extent, it’s just a numbers game, as you will generally be at a far lower risk of losing everything you’ve got if you own 10 different currencies in your crypto portfolio rather than just one.

Clearly, it’s not always that simple. You need to take each investment decision with extreme caution. In the end, you don’t want to diversify through some arbitrary coins that will die next week.

The idea then is to find several coins proven to hold their value. Of course, you can and sometimes should take risks. However, all risks should be calculated. What good is there in having ten apples in your basket if they’re all rotten?

2. Crypto Diversification: How To Diversify Crypto The Right Way?

There is very little point in arguing for either particular cryptocurrency. After all, you will find enthusiasts of general cryptocurrencies such as the most popular Bitcoin (BTC), Ethereum (ETH), and Doge.

On the other hand, some believe that the only coins that are worth anything are stablecoins.

Some invest because they have read the whitepaper revealing how the technology behind the currency works and decided to ‘believe’ in it based on that. Of course, that’s only the tip of the iceberg, as whitepaper means very little. What matters is the coin’s historical performance.

Others follow the hype, for example, Doge or Luna coins. Both were based on public personas, Doge being shilled for by Elon Musk and Luna by Kwon Do-Hyung.

Since DeFi is still a comparatively new space, new projects and great hits like GameFi and NFT appear regularly.

No matter how you look at it, hundreds of thousands of people invest purely based on hope and belief. And that is something you want to avoid at all times. Lucky for you, once you’ve realized how to detect hype and manipulation, you’ll know how to diversify crypto in a safer, calculated manner.

3. Stable Coins or General Cryptocurrencies?

Stablecoins, as the name suggests, are far more stable when compared to general cryptocurrencies like Bitcoin. The reason behind this stability is that they reflect fiat currencies. In other words, they are crypto versions of fiat money.

They are most commonly seen as digital, blockchain dollars that reflect the exchange rate of the USD (or other FIAT currencies) at a ratio of 1:1.

So, in essence, in contrast to general cryptocurrencies, stablecoins offer a constant dollar ratio. Most cryptocurrency exchanges accept stablecoins. They can also be exchanged for fiat without more significant issues. Some of the most popular stablecoins are Tether (USDT), USD Coin (USDC), and Binance USD (BUSD).

Moreover, Stablecoins can be considered a haven of stability and an advantageous position in a cryptocurrency portfolio. Compared to higher-risk cryptocurrencies, they can act as a safe, balancing position.

4. Cryptocurrencies: High-risk and high reward

Compared to stablecoins, cryptocurrencies are like a playground for risk-takers. Let’s look at the price history of Bitcoin, which is widely regarded as the gold standard among cryptocurrencies, and Dogecoin – one of the most famous examples of hype coins. I will compare them to one of the most famous stablecoins, i.e. USDT.

4.1. Historical Bitcoin price (in US dollars):

4.2. Historical Dogecoin price (in US dollars):

4.3. Historical USDT price (in US dollars):

4.4. Historical USDC price (in US dollars):

As you can see in the examples above, the prices of stablecoins remain almost identical to that of the US dollar. The variations are somewhere between $0.97 to $1.03 at the very extremes.

Meanwhile, when it comes to Bitcoin, on May 22, 2010, 10.000 BTC was used to pay for two pizzas. Ten years later, one Bitcoin was worth around $70.000 (2021), an event very few people could have predicted.

5. How To Diversify Crypto And Choose The Right Coins?

Let’s be upfront about it: cryptocurrencies are a volatile market. They are far more volatile than most traditional assets, such as Forex pairs or company stocks. People who try to tell you anything other than that are probably snake oil salesmen.

That said, there are ways of making money in crypto. Whether looking at general cryptocurrencies like Bitcoin, stablecoins like Tether, or NFT and GameFi stuff, choosing the right ones will always be about the same.

- Your main job is to avoid deceptive marketing tactics that overwhelm DeFi. As a trader, you must be aware that dishonest marketing practices will be incredibly prevalent since there is no official body to overlook what goes on in the crypto market.

- It would be best if you strived to detect con artists and focus on hard facts. If you see one coin shilled all over the internet, you can be sure there’s much marketing behind it.

- That’s not to say that this is necessarily bad. However, your job is to approach each investment pragmatically, looking at the project as a whole, reviewing its history, the people behind it, and the reason for its existence.

- A rule of thumb when trading, and when trading crypto, in particular, is: don’t trade any money you can’t afford to lose. You’re far better off holding five well-researched coins that you can monitor and follow closely rather than owning twenty arbitrary marketing-driven shitcoins.

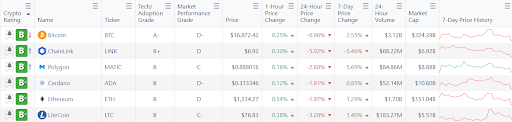

5.1. Weiss Ratings: TOP6 Coins Worth Buying

According to Weiss Ratings, only six coins have earned a rating of B or B-, which means that these are the coins that could be worth purchasing.

Skeptics will say that these ratings are not worth all that much, and, for all I know, they could be right. That said, I’d take a trusted rating over that of a Discord bot any day.

6. Do not Limit Yourself: Crypto, Gold, Forex – Branching Out of Cryptocurrencies

If your first gateway to the world of trading and investing has been crypto, you might be overly focused on finding other coins that might be worth your money.

When compared to traditional finance, DeFi can be considered fresh, fertile soil. However, when diversifying your portfolio, there is no reason not to look for more stable options outside of cryptocurrencies.

6.1. How To Diversify Crypto? Consider exploring other options:

- Trading App for All Assets – Trade Everything in One Place

- Keeping your financial instruments in one organized place can be a game-changer.

- If you want to know how to diversify your crypto portfolio, whether it be crypto, Forex, Nasdaq, or precious metals, it should only make sense to stick to an app that allows you to trade all of them freely.

SimpleFX allows you to trade anonymously and with no trading fees. Start diversifying today with the SimpleFX trading app.

Disclaimer: Please note that this article has been written for educational purposes only, and none of this is financial advice and thus should not be treated as such. We highly recommend seeking professional advice before making any investment-related decisions.