Finding the most undervalued stocks is one thing, but getting ones that have proven their worth to everyone is even better. These stocks are sure to generate a good and steady income. They can also significantly increase your investment value with the right market conditions. We share some of the best and most undervalued stocks currently available on SimpleFX.

Table of contents:

The Most Undervalued Stocks Available on SimpleFX

2022 has had investors facing a lot of volatility and uncertain conditions in the market throughout the year. A lot of risks are affecting them right now, including high-interest rates, rising inflation, and the possibility of a recession, at the same time. During this time, they are looking for potential investments that can stabilize their portfolios regarding the company’s basics and cashflows.

We have prepared a list of stocks on SimpleFX that are currently showing incredible potential for growth and stability. These companies are considered highly undervalued and expected to show stable growth in the coming days and months.

1. Alphabet (GOOG.US)

The parent company of Google (GOOG.US) recently shared its earnings reports which led to a drop of 6% in their stock. Right now, it might be the best-undervalued stock you can buy. YouTube’s ad revenue year-on-year value fell by 2% during the 3rd quarter. It went against analysts’ predictions expecting a growth of 3%.

The company announced multiple steps to ensure cost-cutting, including the closure of Stadia and the cancellation of the Pixelbook laptop’s next generation. Some workforce cuts are also expected in the coming months.

Of course, this also had to do with the 20-for-1 split announced by the company in July 2022. To the less insightful, these things may seem like a negative mark on Google’s stock. However, it is quite an attractive proposition for investors who know where this is headed. With the pullback this year proving to be the steepest in the company’s history, this is undoubtedly a stock you should be taking advantage of.

2. Advanced Micro Devices (AMD.US)

It might surprise some people to see a stock that does not pay dividends on this list. However, AMD (AMD.US) has proven it’s worth more than enough to provide stellar earnings to shareholders. Therefore, it is undoubtedly surprising to see the company battered as much as it has. However, the 51% drop in stock value during the year does not make it a bad deal. It makes AMD.US one of the best-undervalued stocks you can buy right now.

The share value was $55 during mid-October, which is where it was two years ago. Given that the company has seen a considerable rise without the dividends option, investors are still optimistic about upcoming growth making it the most undervalued stock.

The significant impact came from the company not meeting the expected Q3 results on Wall Street. This may have been due to the inflationary and supply-chain issues that the company was facing during the year. Even with the troubles and the shortcomings in their performance, the company did manage to see a growth in revenue of almost 30% during the July-September term.

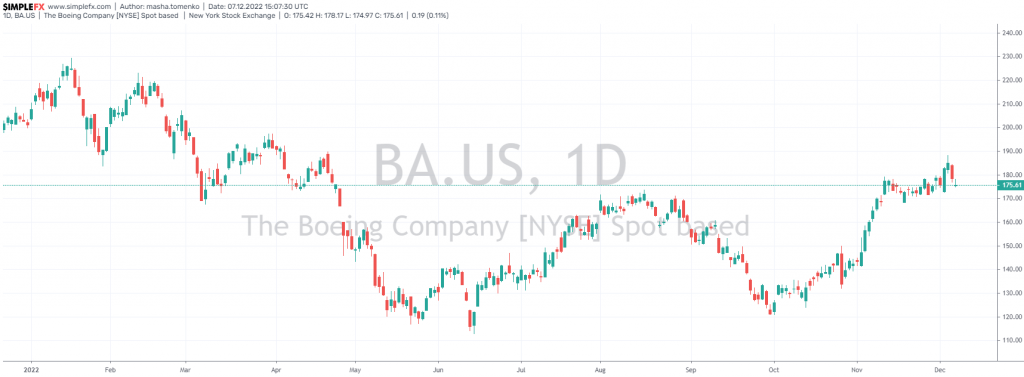

3. Boeing (BA.US)

Boeing (BA.US) has had a bad year, to say the least, especially concerning the several major crashes that people witnessed of its aircraft. The accidents led to a loss of consumer confidence, which makes sense, given how important it is for the company to keep the public happy.

There needs to be more than this negative spell to keep it off our list. Given the 14% devaluation in its stock price, the positive future outcome, and the long-term stability of its market performance makes, Boeing is a highly valued stock you need to buy.

Being one of the only two aircraft manufacturers operating at their production level also gives it a significant advantage, meaning that the business will continue to grow in the coming months. The recent list of appealing contracts won by the company is also a great indicator of that expected success.

4. Pfizer (PFE.US)

This one requires no introduction, and many of you might even be surprised as to how this could be the most undervalued stock given the company’s current global role. The creator of several incredibly successful drugs saw a massive growth in its value after launching the vaccine for Covid-19. The vaccine alone brought in nearly $37 billion in sales in 2021. The sales were expected to be even higher this year, with forecasts sitting around the $55 billion mark with the inclusion of boosters.

All that success did not stop the stock value from dropping by 12% during the current year. The stock-to-earnings ratio is also at just 9.54, making it a cheap stock to buy.

All that success did not stop the stock value from dropping by 12% during the current year. The stock-to-earnings ratio is also at just 9.54, making it a cheap stock to buy.

Of course, this will only be the case for a short time, as anyone who knows anything about stocks knows that this is the opportunity of a lifetime to invest in Pfizer (PFE.US) – one of the most successful pharmaceutical companies in the world.

5. JPMorgan Chase (JPM.US)

Being the biggest lending company in the United States with a market cap of $394 billion and asset management for $4 trillion makes JPMorgan Chase (JPM.US) one of the most valuable companies to invest in. Right now, it is also performing exceptionally well. The 3rd quarter figures for the bank are also meeting the expected levels.

Of course, there has been some volatility, with a significant impact on equity trades and investment banking. This was offset by the high-interest loans the bank was able to provide, and its bond trading also saw an increase.

The overall scenario resulted in a drop of 17% in the stock value. The current price-to-earnings ratio is also sitting at 11, which is quite low for this company. All these factors, when combined, indicate a sweet spot for getting your hands on a stock that is currently undervalued but will not stay so for long. The 7% increase in the past month also indicates how short an opportunity this could be if you want to take full advantage of the situation.

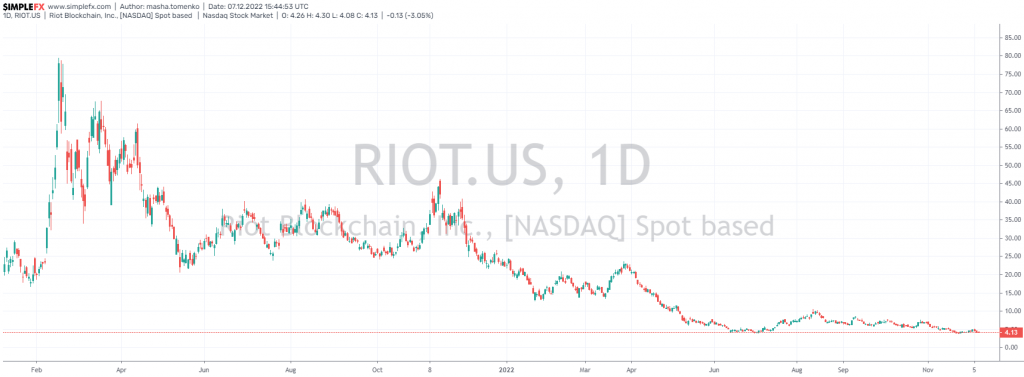

6. Riot Blockchain (RIOT.US)

Riot Blockchain (RIOT.US) is one of the biggest global crypto mining and blockchain tech companies. With a massive stake in bitcoin mining and a partnership with Bitman (the creator of bitcoin mining hardware), the company is set to see significant benefits from the growth of blockchain and bitcoin. We may see its value double in 2023 compared to its current stock value.

The company has 13 significant investors holding more than $13 million shares, the largest being Schonfeld Strategic Advisors. Whether it will pan out exactly like that is anyone’s guess, but there is sure to be a significant increase in its stock value in the coming days and months.

7. Airbnb (ABNB.US)

With the world finally opening to travel fully after Covid-19 restrictions, Airbnb (ABNB.US) has been seeing a steady growth in revenue this year. The Q3 bookings for the company grew by 31%, more than several investors expected. However, with the holidays and other factors affecting its Q4 bookings, a drop of 25% is being seen. It could be a source of the current weakness in the company’s share value.

Some other factors are also present which prove the company’s strengths, which we may witness in the coming year. The company is confident in its ability to grow, and the investors also share their sentiments. With the current share price and the price-to-earnings ratio, it is quite possible that this could be one of the best-performing and the most undervalued stocks to invest in.

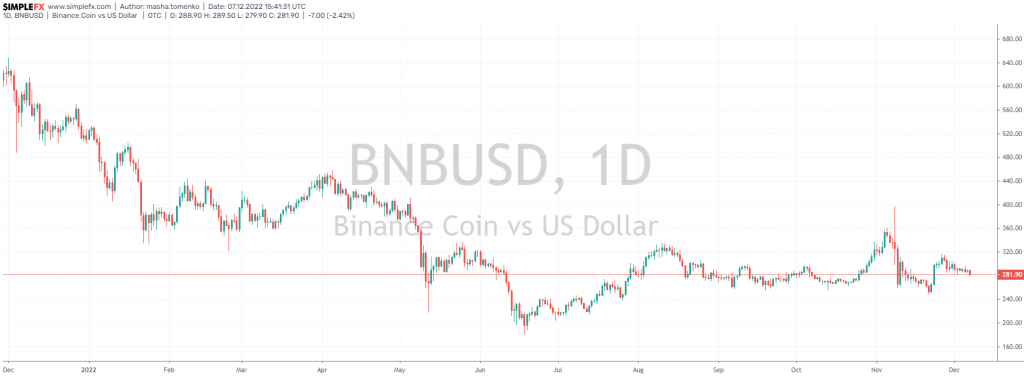

8. BNB

BNB (Binance coin) is backed by the world’s largest crypto exchange, which is more than enough to show its reliability and stability. With the FTX collapse, the reputation of the BNB coin has been cemented even more, and analysts expect the cryptocurrency to blow up exponentially in the coming months.

Despite the volatility in the crypto market, BNB has several features that make it a solid investment option.

Treating it like a stock also makes much sense considering its advantages offers. The best advantage is the lower fees on BNB transactions which creates enough value in the long run for crypto investors. Furthermore, several other successful cryptos are based on the same architecture as BNB.

Most Undervalued Stocks. Summing Up

The stocks shared above are only some of the countless undervalued assets you can use now. These have shown the potential to be prime candidates in terms of their growth potential and positive market expectations. Investing in the most undervalued stocks right now could help you develop a strong portfolio, even with a relatively minor investment. SimpleFX provides everything you need to trade any of these stocks. You can quickly achieve your investment goals for the year if you need a quick boost.