It’s a hot week for financial markets. Big interest rate decisions should make an impact. On Tuesday, we’ll know the Canadian inflation rate in August. The previous month showed a rise in prices, and the expectation was 7.3%. Make sure you follow CAD currency pairs at 12:30 UTC.

Wednesday will be the most important day of the week, however. At 18:00 UTC, the Federal Reserve meets to decide on the interest rates. A hike from 0.75 basis points to 3.35% is expected, but many analysts suggest that the biggest rise in 40 years is also possible by one full basic point to 3.5%. A higher cost of credit may freeze equity and cryptocurrency markets. On the other hand, the stocks have been falling recently, and nobody knows how much of it is already priced in the current valuations.

The following day at 11:00 UTC, a similar event happened for the pound. The Bank of England is expected to raise the benchmark rate from 1.75% to 2.23%. Make sure you follow GBP pairs and the London Stock Exchange, which is closed today due to the Queen’s funeral.

On Thursday, Cardano runs its Vasil upgrade, the most ambitious upgrade in the ecosystem so far.

Here are some assets to watch this week.

ADAUSD

Cardano has not performed well in recent months. After crashing in May, the cryptocurrency missed most of the bullish rallies and is trading around $0.43. The poor performance gives it a space to grow. However, all will depend on the general sentiment in the markets. If the bulls take over after the Fed’s press conference on Wednesday, Cardano should be interesting crypto to target.

SPX500

The US stocks are volatile as the bulls look for the bottom. There is still plenty of room for bears to dig into, with 3600-3700 as local support for STX500. Falling lower would mean reaching an almost two-year bottom from December 2020.

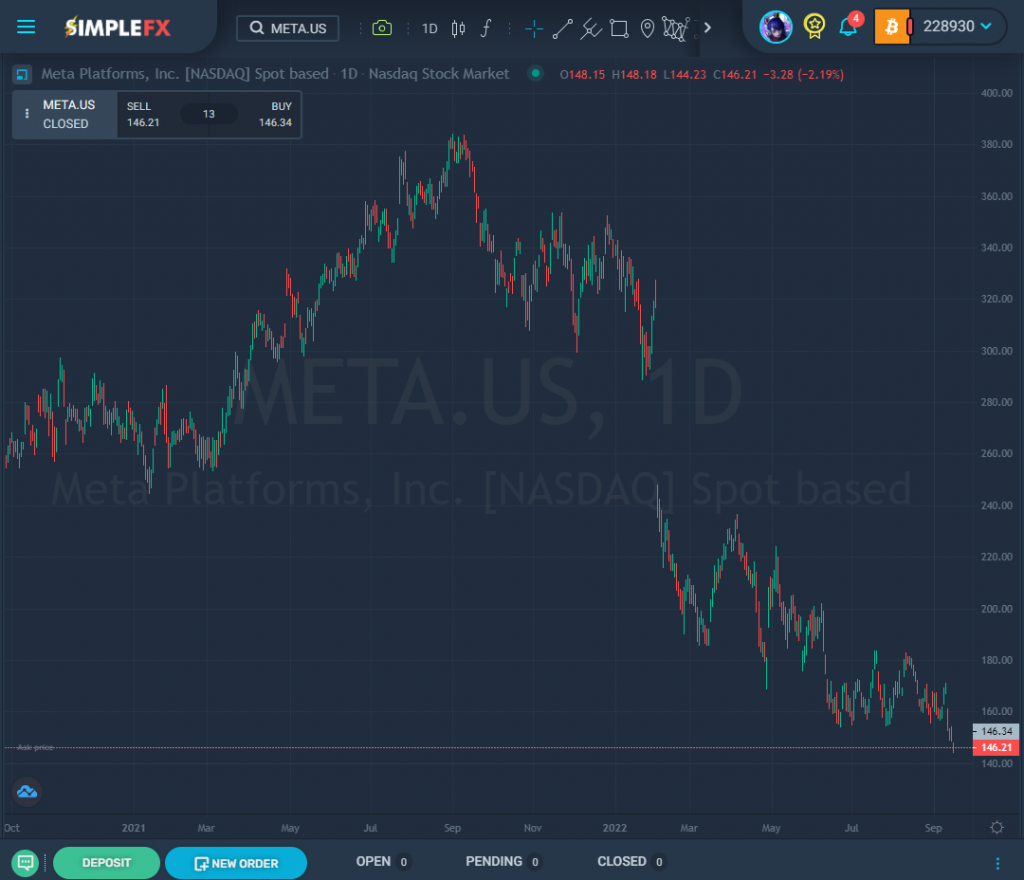

Meta

Facebook, Instagram, and WhatsApp parent company is having a rough time on Nasdaq. Meta’s price fell below the $150 support and closed at $146 per share. If the bear market continues, the corporation with a controversial new strategy may appear to be a decent short target. If we see a reversal this week, Meta may be heavily underpriced.