The equity and cryptocurrency markets have depended on the cost of money. The bull market of 2020 and 2021 was driven by cheap credit. The interest rates remained low while governments spent. Businesses and corporations were growing revenues and profits. Cryptocurrency bulls were alarmed about inflation and presented bitcoins, ethereum, and other altcoins as the best solution to the problem.

Bitcoin was supposed to be the best inflation hedge. A deflationary currency (with a capped supply of 21 million), a perfect store of value, much better than dollars or euros, printed from thin air every day.

Unfortunately, when inflation (and economic slowdown) became a real problem and the Fed, the European Central Bank, and the Bank of England began raising interest rates, the markets went into panic mode. The hysteria is still present.

Will the Fed go all in with one percentage point hike?

We could see it on Tuesday. Both stock and crypto had strong runs. SP500 was 5% in a few days, and bitcoin gained 20%. The US Labor Department posted a customer price index of 0.2% above expectations. BTCUSD crashed 10% within a few hours, and SPX500 lost 4.3% that day.

Now, get ready for an actual bomb next Wednesday, September 21. At 18:00, the Fed has an interest decision meeting, and half an hour later, the press conference is scheduled.

Analysts suggest that the continuation of high inflation could force the Federal Reserve to make the highest interest rate hike in 40 years and go for a total one percentage point increase (instead of the standard 0.75 hikes so far).

“We continue to believe markets underappreciate just how entrenched U.S. inflation has become and the magnitude of the response that will likely be required from the Fed to dislodge it,” the brokerage company Nomura Securities wrote on Tuesday, their clients.

If Fed goes for a one full point interest rate increase to 3.5%, it would be the most challenging decision since the early 1980s, after a decade of extremely high inflation.

In August, the CPI rose by only 0.1%, but the data shows that it would be much faster had the energy prices not decreased. The US inflation slowed down from 8.5% to 8.3%. This is still a very high rate, and many argue that the actual inflation is much higher.

What may happen to the dollar?

The US dollar has been on an exceptional rally, as the risk aversion across the markets causes all capital to flow to the most secure asset – the USD. Against a basket of most major currencies, the USD has had the best year since 1984, up almost 15% this year.

GBPUSD hit the lowest point in 40 years, and EURUSD is trading around a parity reached for the first time in 20 years.

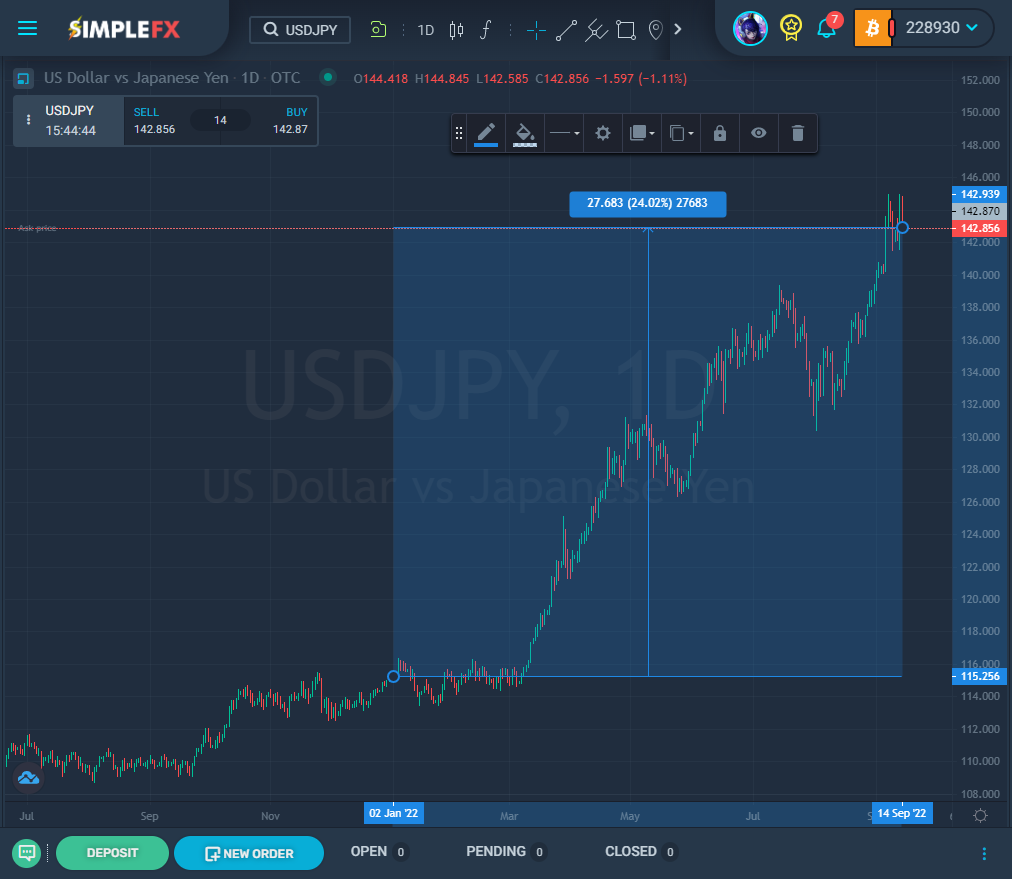

The trend may continue as the ECB is only starting to raise interest rates, the Bank of China is cutting them to rescue growth and the economy, and Japan is keeping them at zero. This international currency market situation makes the Japanese yen a natural victim. USDJPY went up over 25% in 2022.

Cryptocurrencies can’t catch air

With many believers worldwide and some favorable fundamental events, cryptos can’t catch any air. Only when it seemed to work, and BTCUSD broke the $22k resistance again the CPI data popped the bubble once again.

Ethereum is supposed by skeptics to be overpriced right now, as one would expect “buy rumors, sell facts” to work ahead of the Merge.

Unfortunately, the interest rates worries are more substantial than the hype around the most extensive operation in the history of cryptocurrencies. Ethereum will switch to the more efficient proof-of-stake protocol, making all the projects based on the technology work much faster and cost less. Nevertheless, ETHUSD is back again below $1,600.

The Merge will happen around 20:00 UTC tomorrow, September 15. It’s the most important date for the crypto traders, as many new data will come to light. First, we’ll know if the operation is successful; second, we’ll see how many ETH holders and how many tokens will decide to fork and create new crypto (just like it happened before with the Ethereum Classic). Finally, we’ll get to know how much of ETHUSD’s recent price was “buying rumors.”

No matter how exciting the Merge is, the boring Fed’s policy will considerably impact the financial markets. The most significant hike in 40 years will definitely shake the markets. Make sure your SimpleFX accounts are funded and ready tomorrow around 20:00 UTC and next Wednesday at 18:00 UTC.