Why do men dominate the cryptocurrency scene? What is the cause of the problem, and what can we do to change it?

A typical crypto holder or trader is a male close to his thirties. Based on our data of more than 260,000 traders using SimpleFX since 2014, we can say that only 21% of people interested in cryptocurrency are women. Trading crypto is risky, and risk is primarily the domain of men.

However, can we imagine that the cryptocurrency scene can evolve, gain wider adoption, and lower the price volatility to a more female-friendly environment? Well, it’s not happening right now, as we have been going through a highly drastic bear market since the beginning of May. Can we do anything to change the trend and at least reduce male dominance?

Crypto – It’s A Man’s Man’s Man’s World

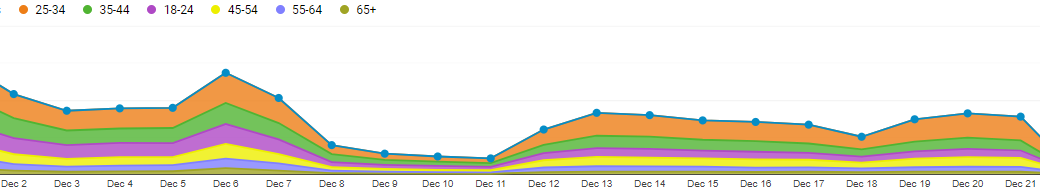

Let’s take a closer look at the crypto community. Firstly, why do people in their thirties so dominate it?

SFX users’ age percentage, December 2021.

Well, that’s no surprise. Most men at this age are in their career prime. It’s the period of life when making money. When we have funds, we simply want to have more. For most users, crypto is an excellent way to get richer quickly. There is also a kind of mental and legal entry threshold as well. Young people often don’t have money or lack their parents’ agreement on investment. Also, most countries allow opening broker accounts at the age of 18.

Although we are coming through a downtrend, at a more significant timeframe, bitcoin, ethereum, and other altcoins have been an excellent way to get money relatively quickly, especially compared to other stagnant financial products offered by commercial banks. Of course, the risk is greater, but where’s the fun without risk? Didn’t our grandfathers risk all they had to discover new lands, establish trade routes, and search for new gold deposits? If we consider crypto to be today’s equivalent of these risky expeditions, we’d understand better that young men still dominate the sector.

Another problem of our middle-aged consumers is the broken pension system, which in most countries is visibly insolvent. In most European countries, it is not a secret that the contemporary professionals in their thirties will have to accept a pension no higher than 30% of their current earnings when they retire.

This is not optimistic data. It’s easy to understand that more people try to multiply their current savings to secure their future. Assuring tomorrow is the goal of many SimpleFX traders from all over the world.

Veteran investors say that diversity is the key. They reduce the risk of loss by getting involved in different assets. It doesn’t matter how one should split it, but one could never know what will be hit in the near or far future and which asset class will plummet.

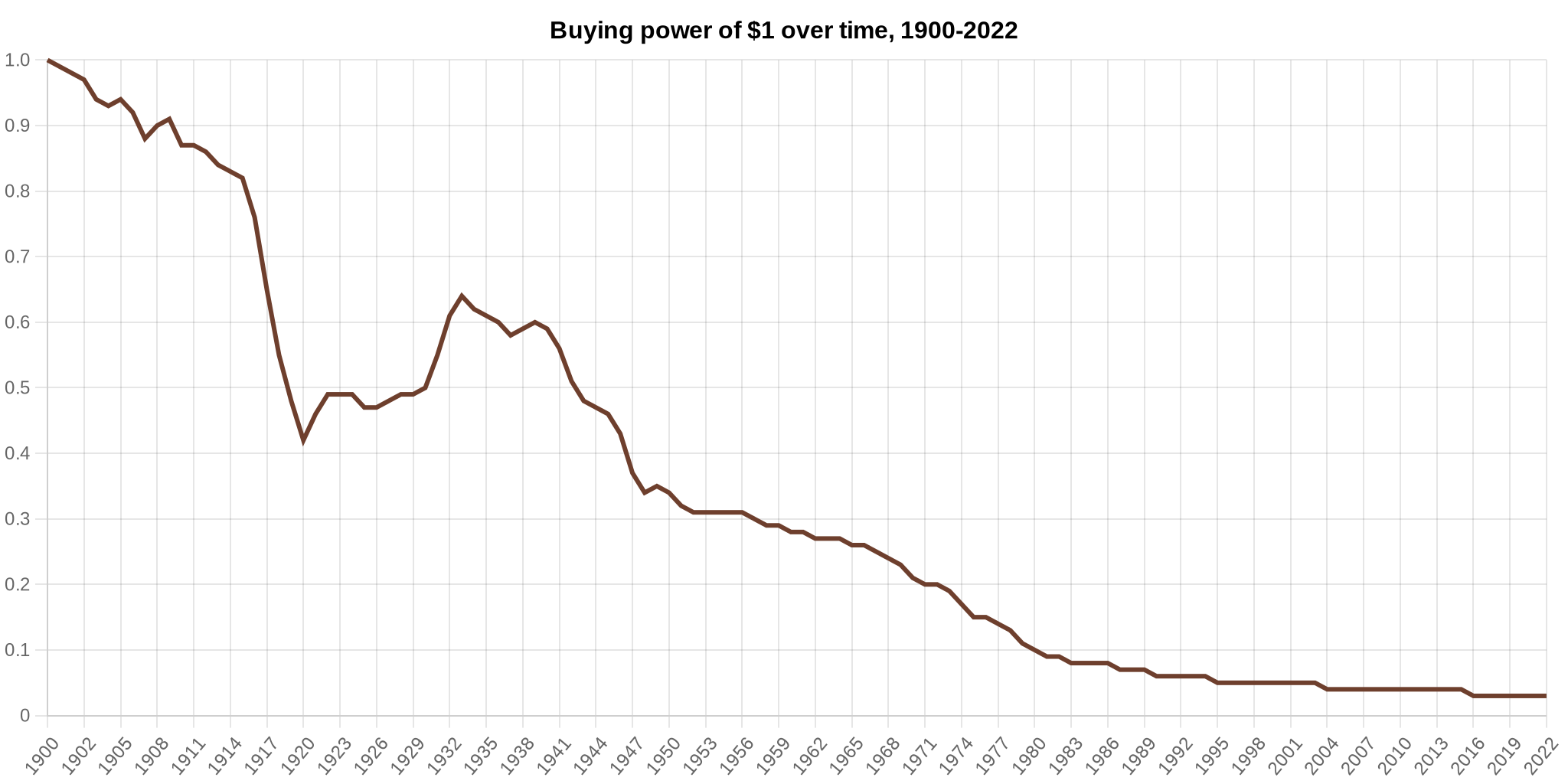

Holding cash is making you poorer every day. Inflation is the growing problem of our times. Dolar, euro, yen, franc, and pound sterling lose their value. What’s worse is the ever-increasing government spending.

Some decide to buy more stuff. Gold, commodities, and cryptocurrencies are the most popular answers.

The purchasing power of $1 overtime. Source: in2013dollars.com

Younger people tend to have much higher risk tolerance. Long-term deposits, bonds, or debentures are not for them. They will accept a potential loss if it’s related to a higher potential profit. Current traditional banking just can’t keep up with the rapidly changing world.

The internet generation wants to see their investment performance in real-time. Inflation is rising fast, and oil price jumps, but deposits stay below inflation. That’s where crypto markets win their battle against banks and traditional financial markets. When trading crypto, one can react to a piece of news or Tweet by Elon Musk and instantly make a buy or sell order.

Why do men dominate crypto?

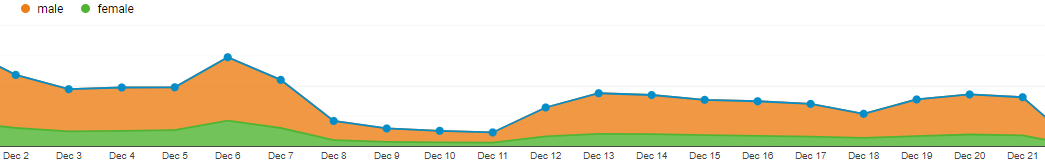

SFX users’ gender percentage, December 2021.

There will be some analogy to the first part of this article. Men want to take the risk and the need to feel the adrenaline flowing in their veins. Of course, this is a generalization, as many guys want to play it safe, and many women are much more reckless than most men. There are many very influential females in crypto, but still, men outnumber them five to one. There were even cases when a person who posted some investment guidance as a woman turned out to be a man in reality.

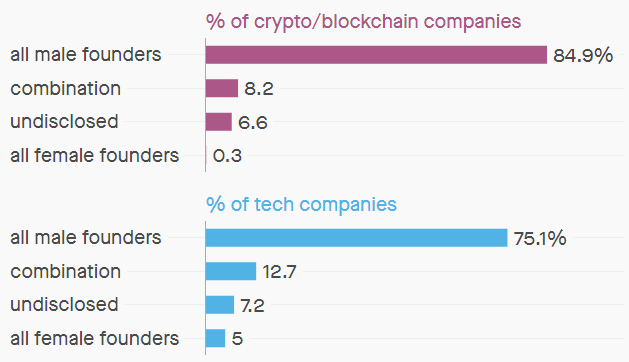

In many countries, Scandinavians are famous for this. The number of women and men in business or politics is well balanced. But it hasn’t happened in crypto yet. Some voices also tell that most company founders around crypto are men. Why is this?

Crypto companies founders percentage on the period of [2012-2018], Source: QZ

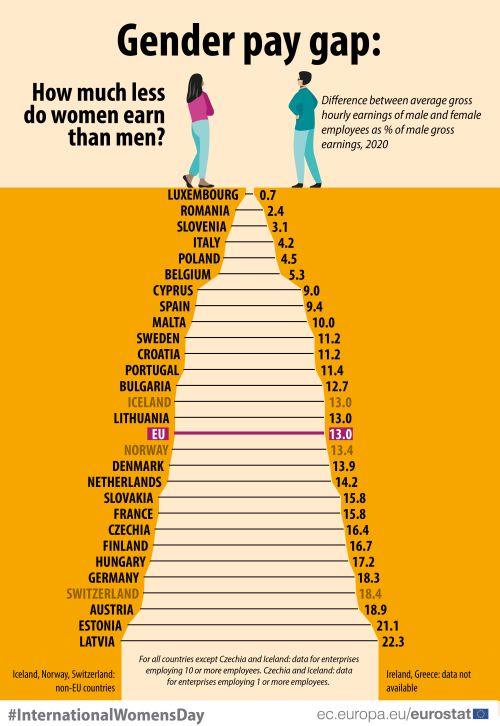

The gender pay gap might be one of the main reasons. Women have to fight for their money harder, so they will have and have less money to invest. So as the European Union stats below show – there is still much to do about women’s earnings.

The gender pay gap in Europe, Source Eurostat

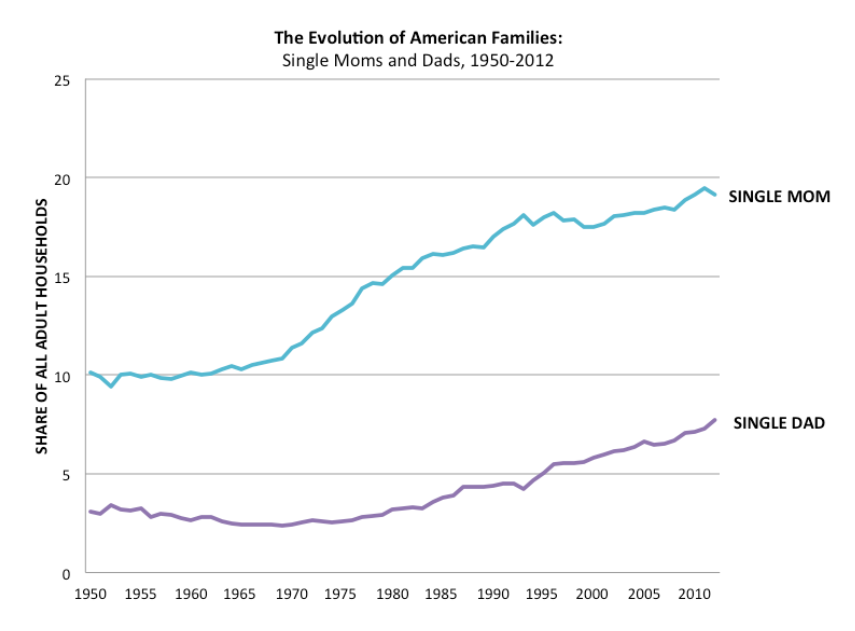

Women become much more often single mothers than men become single fathers. It’s a characteristic of our species that is very difficult to overcome. As expected, this will lead to a lot less money that can be invested.

Single mothers vs. single fathers. Source Ricochet.com

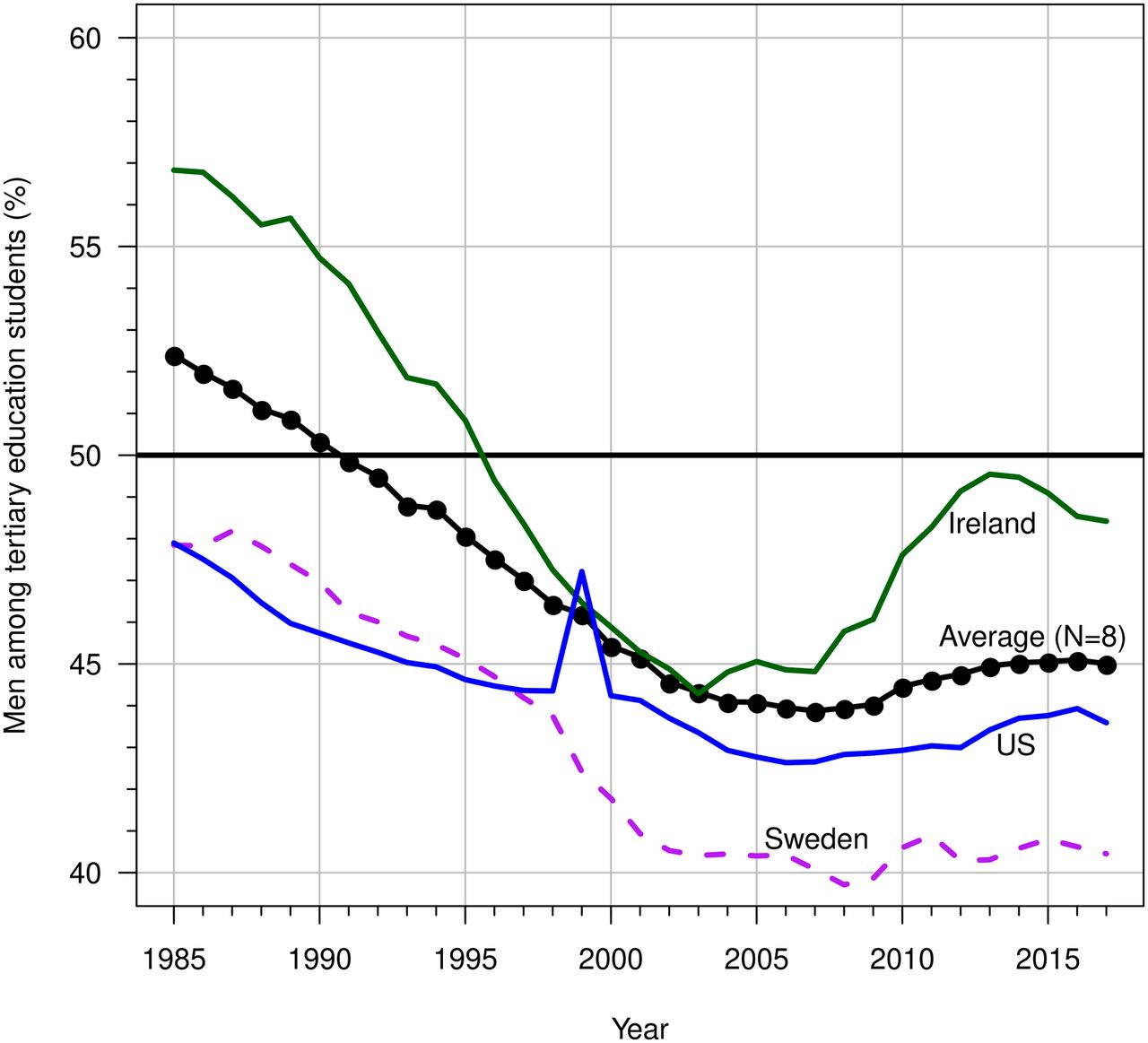

The knowledge gap may be another reason. According to OECD and Eurostat, women tend to get much more educated. Firstly, it will most likely make them make more rational decisions when compared to men being much edgier. But that’s not the only thing the knowledge gap may cause.

Men percentage between students, source: Pnas.org

People taking higher education start their jobs later in life. So by their thirties, women will have a lot less money gathered. They have invested much more time in their professional careers than average men. Starting a family and having children will introduce another long break in their career and drastically decrease their risk tolerance. Yet there is a chance that better education will give them better pay later in life.

But simply calculating that a person starts working for 36 000$ per year at the age of 20, by 30 that person would have accumulated 396 000$ even without any raise in between. Typical studies end at age of 26, so to get even at the age of 30 one should start earnings at a level of about 79 000$. That is more than twice the payment less educated people earn. And it’s still the least possible option as a typical person gets a raise once every 2 or 3 years.

How can we balance men and women in crypto?

What can be done to convince more women to try crypto? How do we make cryptocurrencies more popular in other age groups?

First, we should make cryptocurrency a broadly-accepted payment method. It’s still a bit of a mystery for a lot of people. We should make all businesses accept it as a standard payment method like cash, credit card, or mobile payments.

Second, let’s make the world know that cryptocurrencies are for everyone. Crypto is a user-friendly payment method. No one looks at your skin color, sex preferences, language, or gender when paying with your bitcoin or Metamask wallet. Real money is safe, inflation-proof, and grants you more privacy than any credit card, where you sign each transaction with your name.

Third, when you give your children some pocket money, why do you always use cash? Let’s try crypto. You can even create a smart contract that activates the funds when they do their homework or clean their rooms with many blockchains.

You can make crypto pocket money a great lesson about the financial market. Make it 1$ for starters, have fun watching change. We don’t say watching it grow.

Then introduce crypto to your parents or grandparents. Give them a chance to try some new things and diversify their savings. Older generations are the ones who lose the most on inflation and negative interest from fiat money deposits.

Finally, pressure your local politicians to introduce crypto payments for public transportation, parking tickets, museums, etc.

Be the change!