Fed will announce key inflation data on Wednesday. The event will affect global markets across the board.

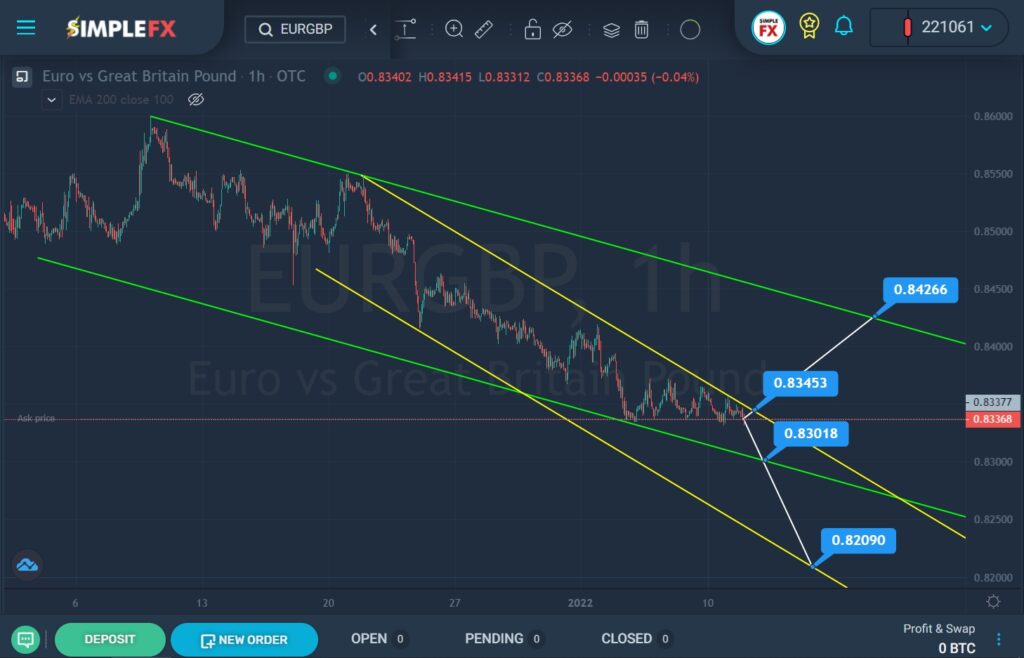

The formation of the EURGBP pair suggests the construction of a large downtrend that moves within the green channel. We see that at the end of December, the market reached the upper green wall, after which the price turned around and began to move in a downward direction within a small yellow channel.

In early January, the price touched the lower green line, but the bears failed to break through it, the price pushed off and continued its movement sideways to the upper yellow line.

Currently, the market is located near the upper yellow line. There is a chance that the bulls will be able to break through the resistance level of 0.834. When this level breaks, they will open the way to the upper green line and the support level of 0.842.

In the last section of the chart between the upper yellow wall and the lower green line, we can see that a correction figure has formed in the form of a triangle, which may soon be completed. Usually, after the completion of the triangular figure, the market continues to move in the same direction in which it moved before its construction. Thus, priority is given to the second scenario, in which the market is expected to decline. On the bears’ way, we see a green line and a support level of 0.830. If it breaks, the price will continue to fall to the next support level of 0.820, located on the lower yellow wall.