The biggest forex players are asking themselves, when will euro rebound. Investors are closely monitoring the labor market data in the United States which are going to be published at 12:30 on Friday. Nonfarm payrolls should offer insights into when the Federal Reserve will return to normalization.

The data is going to influence other pairs, such as GBPUSD, which we analyse in the second part of the post.

Make sure you are trading when nonfarm payrolls are posted today.

For the EURUSD currency pair, we see the construction of a large downtrend that moves inside the green channel.

In the first half of September, the price reached the upper green wall, then began to slowly fall down within the yellow channel. We are currently in the lower yellow area. Perhaps the market will continue to move down and will soon reach the support level of 1.1491, which is on the lower yellow line. With a successful break of this level, the price may continue to fall to the support level of 1.143, which is on the lower green line.

Alternatively, an upward move of the market is assumed. If the bulls reach the resistance level of 1.165, which is on the upper yellow wall, and then break through it, then a path will open for them to the upper green line and the resistance level of 1.174.

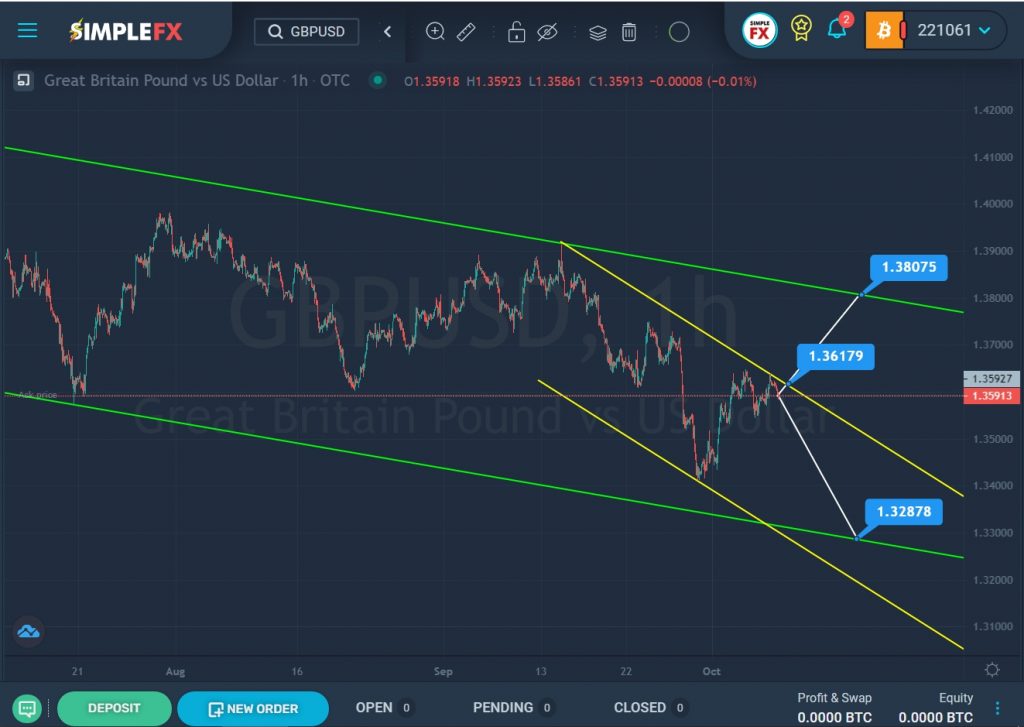

For the GBPUSD currency pair, we see the construction of a large downtrend forming within the green channel. As for the Eurodollar, in the last section of the chart, we see a downward movement of the price inside a small yellow channel.

We see that over the past week the price has jumped sharply from the lower yellow wall to the upper yellow wall. It is assumed that the bulls have taken the initiative, so in the near future, a break of the resistance level of 1.361 is possible, after which the pair can rise to a higher resistance level of 1.380, located on the upper green line.

If the bulls do not have enough strength to break through the upper yellow wall, then they will have to give in to the bears. Then market participants are waiting for a downward price move in the direction of the lower green line and the support level of 1.328.