USDCHF has been climbing fast recently, however, new economic data has shaken the US dollar a little bit. Still, our analysis would suggest a rise in a long time.

In the second part of the post, we’ll take a close look at EURGBP. The British pound is doing surprisingly well in the post-Brexit world.

The formation of the USDCHF currency pair shows the development of an uptrend, which is rapidly growing within the green channel.

In the first half of March this year, the price reached the upper green line, after which it pushed off from it and began to decline.

In the last section of the chart, we see that the bulls are not giving up, and are trying to dominate the bears. Thus, it is possible that in the next coming days the price will reach the resistance level of 0.948, which is on the upper line of the yellow channel. The yellow channel is built on the tops of the last two highs. If the yellow wall is successfully broken, the bulls will open the way to the upper green line and the resistance level of 0.965.

Alternatively, the currency pair may decline to the support level of 0.929, which is common for both the yellow and green channels.

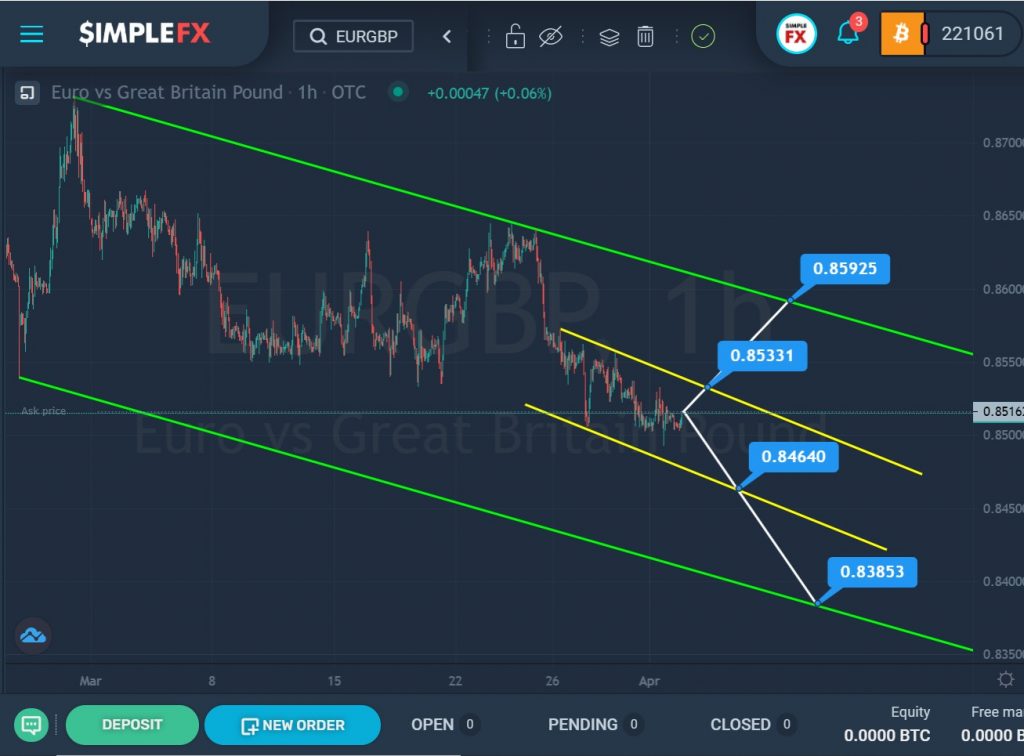

On the 1H timeframe for the EURGBP currency pair, we see the formation of a downtrend that moves inside a large green channel.

Recently, the price touched the upper green wall, after which the market began to move in a downward direction within a small yellow channel. At the moment, the price is located approximately in the center of the yellow channel, as well as in the center of the green channel. In the current situation, both the beginning of growth and the continuation of the decline of the EURGBP pair are possible.

If the price reaches the upper yellow border and can break through the resistance level of 0.853, then the bulls will have a clear path to the upper green wall and a resistance level of 0.859. However, if the price goes down and the market can break through the support level of 0.846, which is on the lower yellow line, then we will continue to decline to the lower green line and the support level of 0.853.