Gold and silver prices fell sharply yesterday, but have already started to recover. This only makes things more interesting for SimpeFX traders, as open more possibilities to leverage the right orders. NYSE ended Thursday trading in the red as well. S&P 500 lost 60 points after a very volatile trading session. Take a look at SimpleFX outlook for the next hours and days, and trade accordingly.

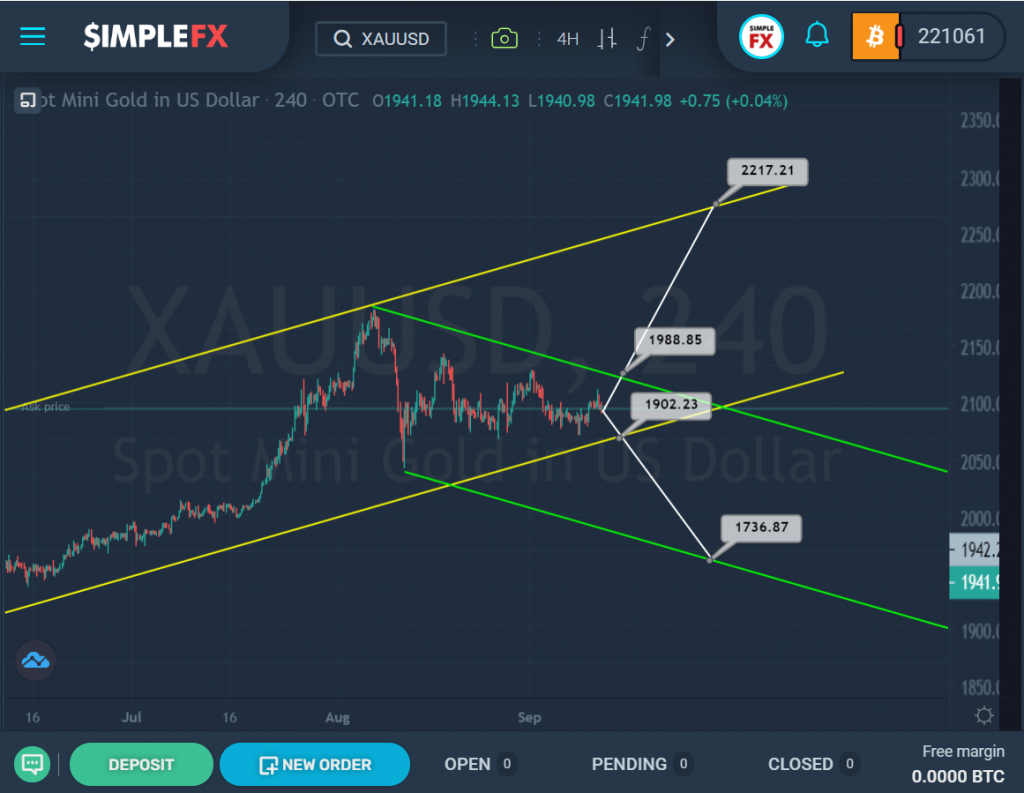

XAUUSD has been forming an uptrend for a long time, which moves inside the yellow channel.

Recently, gold pushed off from the upper line of the yellow channel and began to move in a downward direction, forming a new green channel. If the market continues to move further down, and the bears can break through the support level of 1902.23, which is on the lower green line, then XAUUSD will open the way to the lower green wall and the next support level of 1736.87.

There is also a high probability that the market will move even closer to the upper green wall, as it is currently in this area. If the resistance level of 1988.85 breaks, the bulls will open a path to the upper yellow line and the resistance level of 2217.21 located on it.

SimpleFX SPX500 Chart Analysis: September 11, 2020

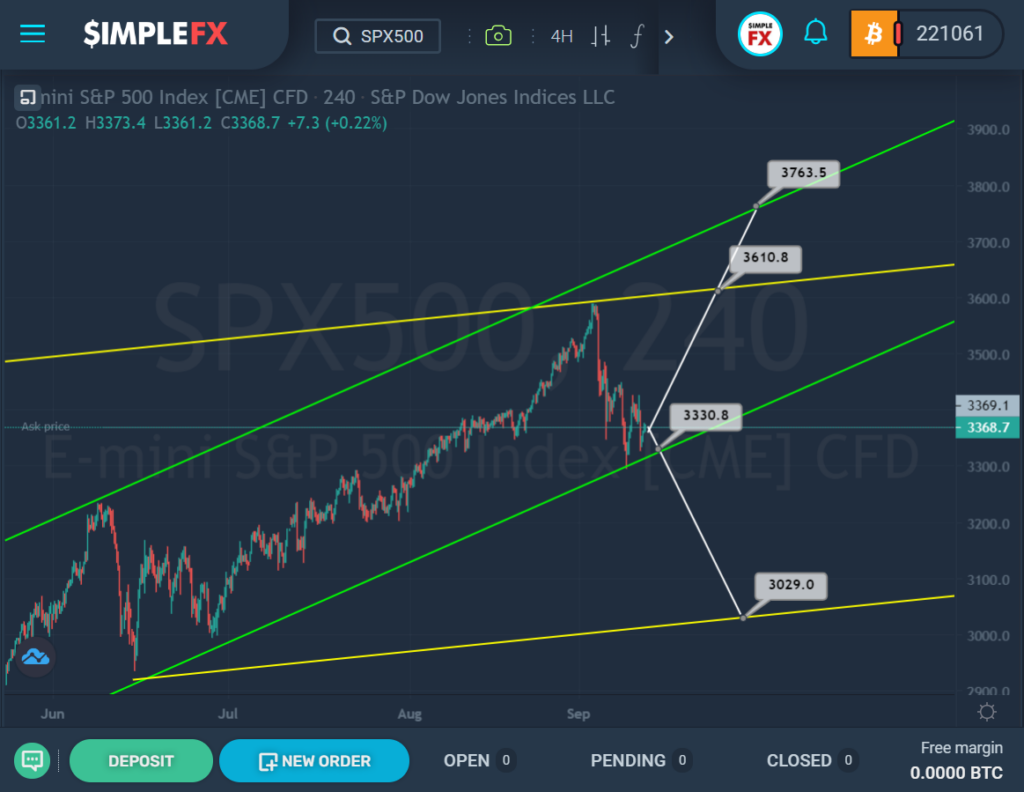

The current SPX500 structure indicates that the market is moving within two fairly large ascending channels. For a long time, the price moved from the lower line of the green channel to the upper yellow wall, from which we saw a rebound and a repeated decline to the lower green line.

Now the market is near the support level of 3330.8, if it breaks down, the bears may open the way to the lower line of the yellow channel and the next important support level of 3029.0.

An alternative scenario can be implemented if there is a rebound from the lower line of the green channel and a bullish trend in the direction of the upper yellow wall and the resistance level of 3610.8. Then, in the event of a break above this resistance, the growth will continue to the next line and the resistance level of 3763.5.

It is preferable to add this pair on our watchlist!