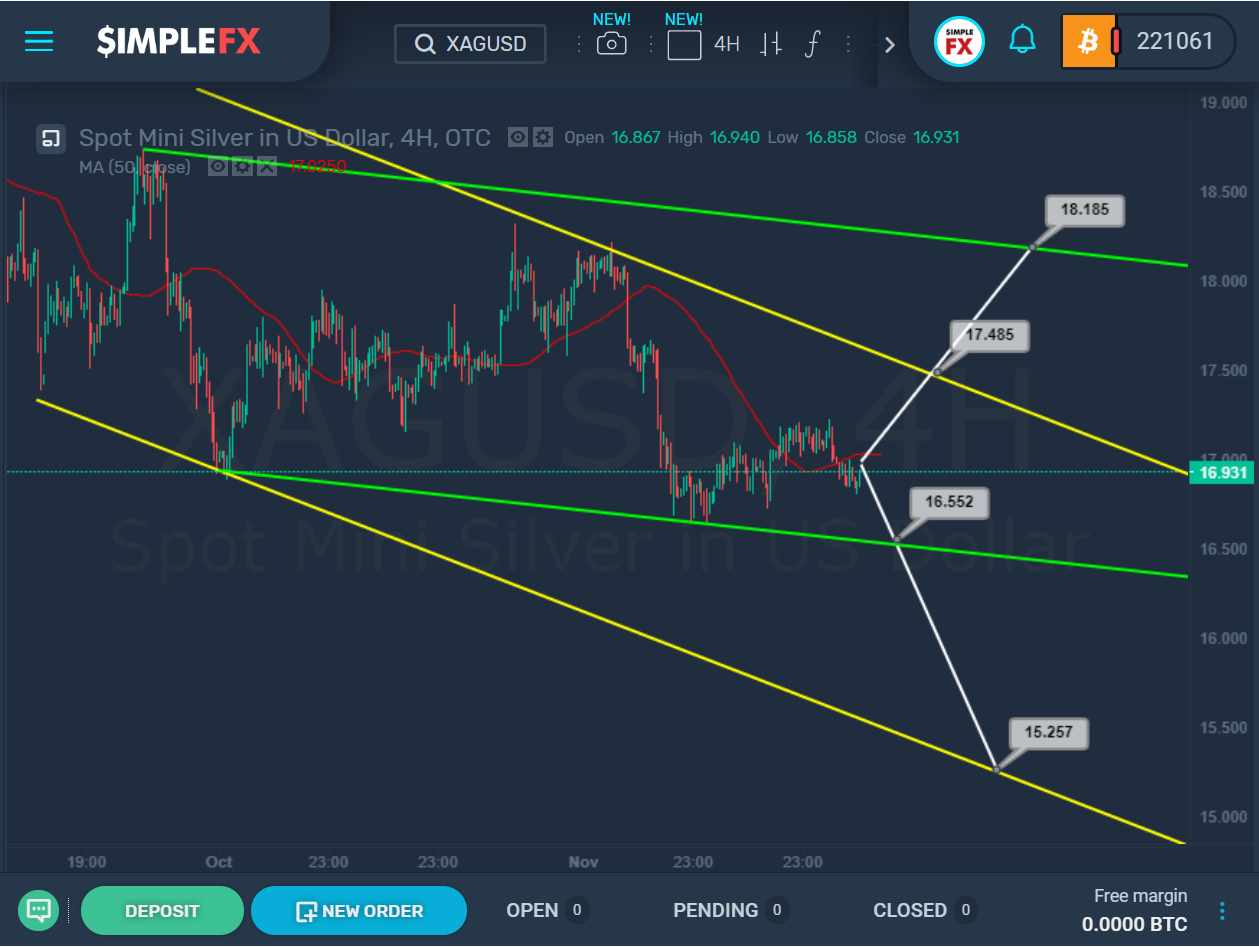

At the moment, the price movement can be described by two descending channels, green and yellow. The price is gradually clamped between the upper yellow and lower green walls. It is not clear who will win in this confrontation, bulls or bears.

At the moment, the price movement can be described by two descending channels, green and yellow. The price is gradually clamped between the upper yellow and lower green walls. It is not clear who will win in this confrontation, bulls or bears.

If the decline continues in the near future, and the bears overcome the support level of 16.55, which forms the lower wall of the green channel, the market may continue to move in a downward direction up to the lower bound of the yellow channel and the support of 15.25.

However, if the price rises and the resistance of 17.48 breaks, the bulls will open the way to the upper green bound and the resistance level of 18.18.

Therefore, to make trading decisions, it is recommended to wait for the break of the nearest yellow or green wall.