A skilled margin trader knows how to benefit from market swings. The best way to do it is to follow the news, try to read the sentiment, and have a great trading app ready in your pocket to make the right order at the right time.

Here’s an outlook for 2020 prepared by SimpleFX WebTrader an easy-to-use award-winning margin trading app with cryptocurrency accounts, no minimum deposits, high maximum leverage. With SimpleFX WebTrader you can easily plan your strategy on a laptop or desktop and execute it anywhere any time on your mobile. All this using the same application that automatically adjusts to any screen size.

The rich smell sell-off

A good strategy is to follow the market leaders. As the major US stock indices – Dow Jones, Nasdaq and S&P 500 were breaking historical records last week, some of the richest people around the world are preparing themselves for a stock sell-off, according to a report by UBS Global Wealth Management.

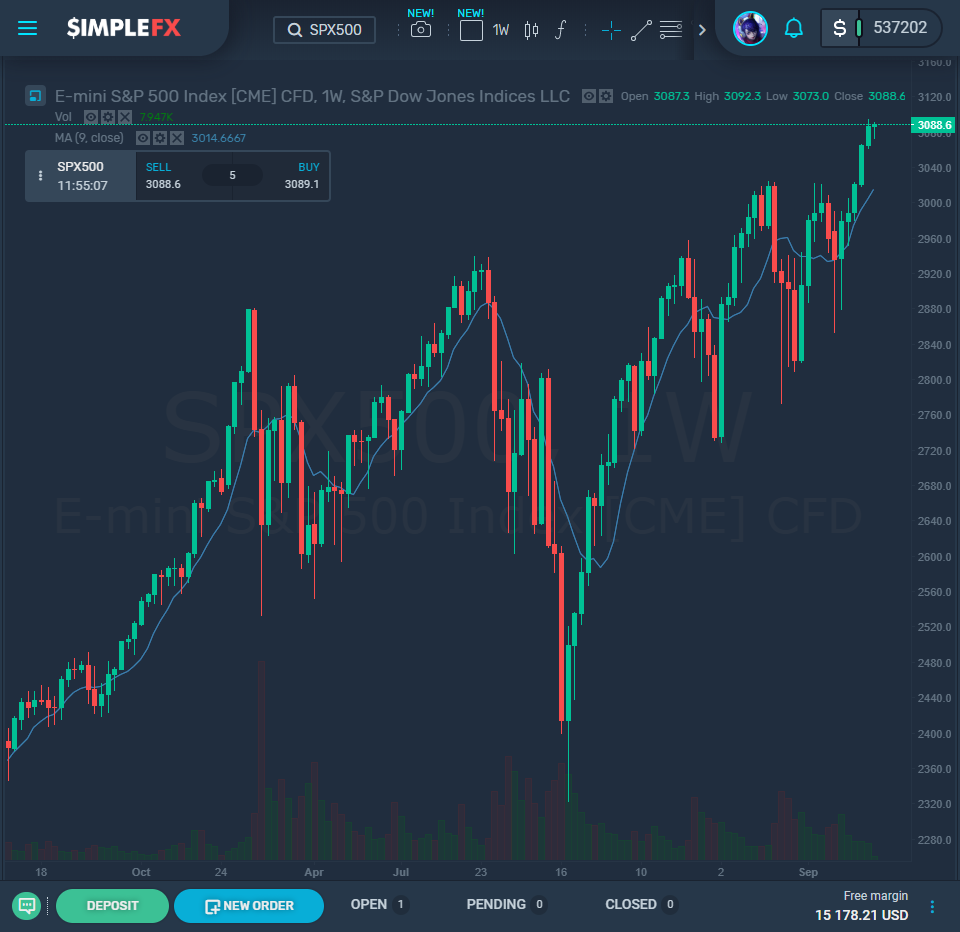

S&P 500 went to historic highs recently. Source: SimpleFX WebTrader

The most affluent investors expect stock markets to drop in 2020. What’s their response? They keep a larger part of their portfolio in cash. According to UBS on average as much as 25% of their assets. The report was based on a poll among 3,400 wealthiest investors around the globe, with investable assets of at least $1 million.

What do the most wealthy investors expect? As many as 55% of them expect a significant market sell-off. However, the same group of investors is optimistic about the stock markets and their general investment returns in the long term of the next decade.

Open and close orders when the right time comes anywhere.

Watch out for those risks

What are exactly the risks to the markets that you should pay attention to? The chief economist of Deutsche Bank Torsten Slok has prepared a list of top 20 risks to global markets in 2020. Each one of them may trigger a downtrend.

- A continued increase in wealth inequality, income inequality, and healthcare inequality.

- Phase one trade deal remains unsigned, continued uncertainty about what comes after phase one.

- Trade war uncertainty continued to weigh on corporate capex decisions.

- Ongoing slow growth in China, Europe, and Japan Triggering significant US dollar appreciation.

- Impeachment uncertainty & possible government shutdown.

- US election uncertainty; implications for taxes, regulation and capex spending.

- Antitrust, privacy and tech regulation.

- Foreigners lose appetite for US credit and US Treasuries following Presidential election.

- MMT-style fiscal expansion boosts growth significantly in the US and/or Europe.

- US government debt levels begin to matter for long rates.

- The mismatch between demand and supply in T-bills , another repo rate spike.

- Fed reluctant to cut rates in an election year.

- Credit conditions tighten with more differentiation between CCC and BBB corporate credit.

- Credit conditions tighten with more differentiation between CCC and BBB consumer credit.

- Fallen angels: More companies falling into BBB. And out of BBB into HY.

- More negative-yielding debt sends global investors on the renewed hunt for yield in US credit.

- Declining corporate profits means fewer dollars available for buybacks.

- Shrinking global auto industry a risk for global markets & economy.

- House price crash in Australia, Canada, and Sweden.

- Brexit uncertainty persists.

Profitable trades for everyone

You can use the knowledge of the most wealthy investors and make high profits on your own. Thanks to high maximum leverage and no minimum deposits you can get huge returns investing and risking little.

Thanks to easy and secure payments that can be performed in both fiat money and cryptocurrencies with SimpleFX WebTrader everyone can access and benefit from trading with low spreads.

With SimpleFX accounts, you can use fast and secure cryptocurrency deposits from anywhere.

SimpleFX offers an attractive 1:500 leverage, which opens profit opportunities to the less affluent traders. At the same time, easy stop-loss feature and negative balance protection make SimpleFX a secure tool for both experienced and novice traders.

Give SimpleFX a try and join the community of over 200,000 traders worldwide.