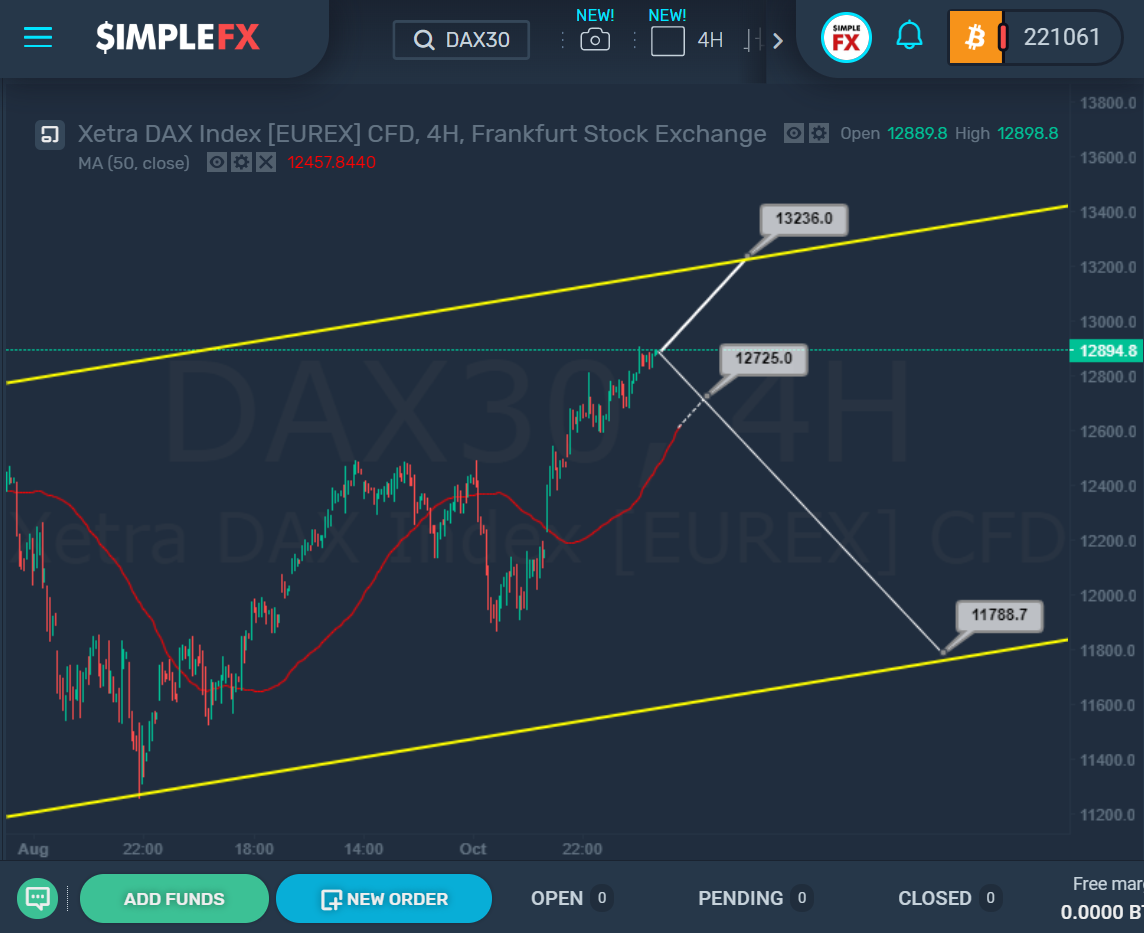

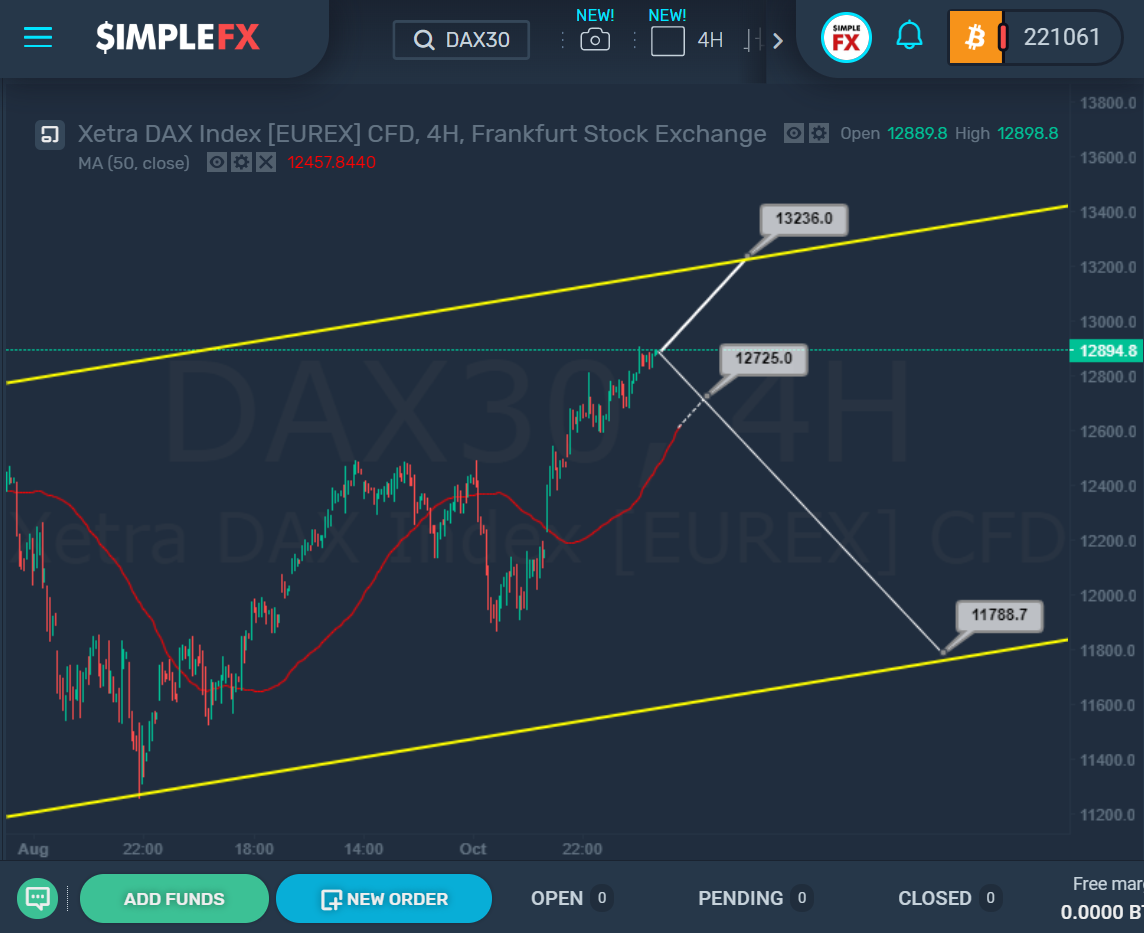

Most likely, we see the growth of the market to the upper bound of the yellow channel and the resistance level of 13236. Thus, during the next trading week, the bulls can reach this target level. However, in this situation, there is an alternative scenario. If the bears begin to gain potential and the market breaks below the moving average near the support level of 12725, they may open the way to the support level of 11788, which is located on the lower bound of the yellow channel.

Most likely, we see the growth of the market to the upper bound of the yellow channel and the resistance level of 13236. Thus, during the next trading week, the bulls can reach this target level. However, in this situation, there is an alternative scenario. If the bears begin to gain potential and the market breaks below the moving average near the support level of 12725, they may open the way to the support level of 11788, which is located on the lower bound of the yellow channel. Most likely, we see the growth of the market to the upper bound of the yellow channel and the resistance level of 13236. Thus, during the next trading week, the bulls can reach this target level. However, in this situation, there is an alternative scenario. If the bears begin to gain potential and the market breaks below the moving average near the support level of 12725, they may open the way to the support level of 11788, which is located on the lower bound of the yellow channel.

Most likely, we see the growth of the market to the upper bound of the yellow channel and the resistance level of 13236. Thus, during the next trading week, the bulls can reach this target level. However, in this situation, there is an alternative scenario. If the bears begin to gain potential and the market breaks below the moving average near the support level of 12725, they may open the way to the support level of 11788, which is located on the lower bound of the yellow channel.