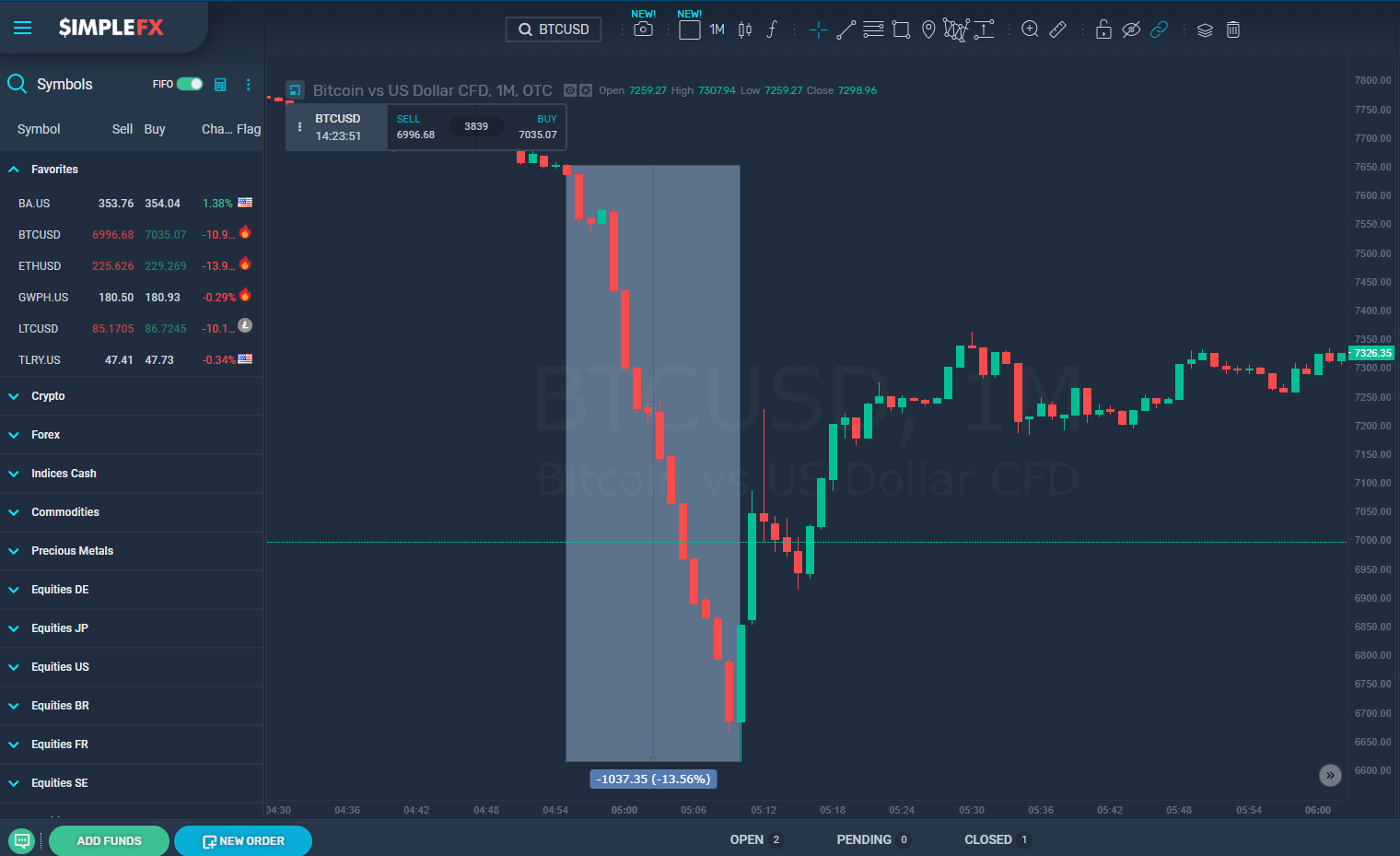

Bitcoin did it again! Price movements such as -13.5% in 15 minutes are something you should expect to happen from time to time on the cryptocurrency markets.

On Friday morning Bitcoin lost more than $1,000 in just a quarter hour. There are several possible explanations to what seemed to be a flash crash as the cryptocurrency quickly recovered most of the value lost, but since then has not returned to the previous levels.

The trace leads to Bitstamp crypto exchange, where a single trader opened a sell order for as much as 5,000 BTC at a surprisingly low price of $6,200 more than $1,000 below the market price at the time. The trade was worth $31,000,000 while it could roughly be worth $5,500,000 more.

Nobody knows if it was a human (fat finger) error, an algorithm malfunctioning, or maybe a “whale dump” manipulation letting others enter the market at an artificially low price. According to some traders, the latter seems unlikely as the volume levels after “the dump” don’t suggest it. However, traces are easy to cover on the decentralized crypto markets.

What are the learnings we should take from this event? I’d underline two main takeaways:

- At the moment the global cryptocurrency liquidity is so low that individual mistakes (or manipulations) can lead to extreme price movements. You don’t need to involve George Soros to do it. Countless people all over the world can move the price.

- When trading cryptocurrency, remember to set stop losses. Even if you want to take a very risky position, set a loose stop loss. Give yourself a chance not to zero your trading account when the next move against your position happens.

That’s it. Good luck trading with SimpleFX and congrats to all of you who shorted BTCUSD before Friday’s morning. Let’s see what happens next 🙂